30份地图和图表让你看透中国 [美国媒体]

中国主席习对美国的访问催生了大量介绍中国权威的文章。现在我们把这些一起放在Wonkblog制成一个长篇报导。评论中不乏有中国网友的评论称终于有人客观的看待中国了!

The visit of Chinese President Xi Jinping to the U.S. has prompted lots of definitive articles explaining China. We here at Wonkblog put together a voluminous one of our own

中国主席习对美国的访问催生了大量介绍中国权威的文章。现在我们把这些一起放在Wonkblog制成一个长篇报导。

But maybe you prefer not to read so many words, and just look at pictures instead. If that's the case, here are 30 charts and maps that will explain China today. You can click on any map or chart to enlarge it.

Did I miss any good ones? Share them with me on Twitter.

但是也许你不喜欢读很多单词,只喜欢看图片。如果是这样,这里有30份图表和地图,直观地解释今天的中国。你可以点击任何地图或图表放大。

若我遗漏了些什么,请在推特上与我分享。

China's population is really, incredibly huge.

The map below by Max Galka of Metrocosm helps to demonstrate that. The land area of each country is sized to be proportionate that country's share of the global population. China and India are massively bloated, while the U.S. has gone on a diet. In fact, many Chinese provinces have populations equivalent to Germany, the Philippines or Thailand.

中国人口十分之巨大

下面由马克斯Galka Metrocosm提供的地图有助于证明这一点。在这张地图中,每个国家的土地面积大小的比例与占全球人口的比例相匹配。可以看到,中国和印度都已经大规模臃肿,而美国则显得瘦小许多。事实上,中国许多省的人口相当于德国、菲律宾和泰国整个国家的人口。

Max Galka, Metrocosm

图片:马克斯GalkaMetrocosm

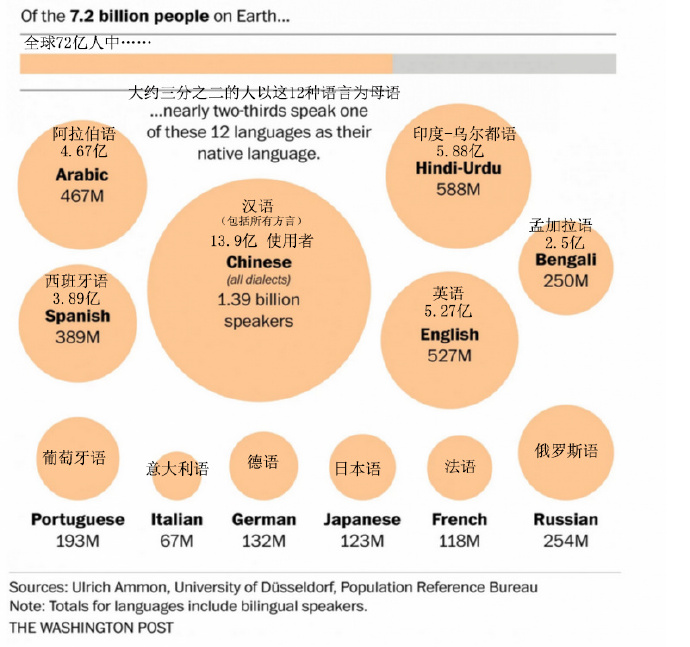

The Chinese language has more native speakers than any other language.

The chart below, by Rick Noack and Lazaro Gamio of The Washington Post, shows the global population broken down by language. Again, you can see China's dominance. Chinese (including all dialects, which in some cases could be considered separate languages -- see below) has significantly more native speakers than Hindi-Urdu, English, Arabic or Spanish.

以汉语母语的人比任何以其他语言为母语的人都多。

下面的图表,由《华盛顿邮报》的 Noack里克和拉萨罗Gamio提供 ,展示了全球人口以语言为标准的划分格局。同样的,你可以看到为这方面中国的主导地位。汉语(包括所有方言,在某些情况下可以被认为是独立的语言,见下文)比印度-乌尔都语、英语,阿拉伯语或西班牙语有些更多的母语使用者。

Lazaro Gamio, Washington Post

China is more diverse than you might think.

One thing people outside of China may miss is the country's incredible diversity. A lot of Chinese are of the same ethnic group, Han, and almost everyone learns the national language, Mandarin, in school. But many people in different parts of China grow up speaking languages that are mutually unintelligible -- as different or more different from each other than European languages.

中国比你想象的更加多样化。

中国之外的人很可能会想不到的一件事是其令人难以置信的多样性。很多中国人都同属一个民族,汉族,几乎每个人在学校都学习国语,普通话。但是对于很多在中国不同地区成长的人来说他们各自讲的语言是无法互相沟通的——和欧洲各国的语言不尽相同的情况相似,其差异甚至还更加之大。

"China linguistic map," Wikimedia Commons

“中国语言地图,”维基提供

The food is diverse, too!

Most Chinese restaurants market themselves in the U.S. as "Beijing" or "Szechuan/Sichuan." But those are only two of China's many yummy cuisines. In the map below, researchers at MIT used computer programs to analyze a database of recipes. They mapped the divisions below based on differences in their ingredients.

食物也十分丰富多样!

大多数中国餐馆在美国推销自己是“北京”或“四川/四川"美食,但是那只是中国拥有许多美味的菜肴的各省其中的两个省份。在下面的图中,麻省理工学院的研究人员使用计算机程序分析食谱的数据库。他们根据不同地域的菜系绘制了下面的分类地图。

MIT Technology Review

China contains what could be called the world's biggest city.

Since you know how big China is, you might not be surprised at the colossal size of its cities. This graphic from the World Bank charts global cities in terms of their population and land size.

The report classifies the Pearl River Delta, an area of southern China across from Hong Kong, as a city, since it argues that all the urban centers in the region run continuously together. Counted this way, the Pearl River Delta is the world's biggest city, bigger than Tokyo. Shanghai is third.

中国有着世界上最大的城市。

因为你知道中国有多大,你可能不会对其巨大的城市规模感到惊讶。下面的图表是世界银行统计的全球城市人口和土地大小表。

这份报告把位于华南珠毗邻香港的江三角洲当作为一个城市,因为它认为在此地区所有的中心城市是一齐连同运转的。按照这种方式计算,珠江三角洲是世界上最大的城市,比第二东京更大,上海排第三。

World Bank, http://www.worldbank.org/content ... 0Development/EAP_Ur

图:世界银行, http://www.worldbank.org/content ... 0Development/EAP_Ur

China's growth has made the world a more equal place.

China's development over the last few decades has lifted 500 million people out of poverty; it is basically the reason the UN has accomplished so many of the Millennium Development Goals set in 2000.

The chart below, by Max Roser of Our World in Data, shows that China's growth has had a big influence on the way wealth is distributed around the world.

The vertical axis shows the number of people in millions, while the horizontal axis shows earnings per person per year. The red line represents how the world's income was distributed in 1820. So, looking at where the red line peaks, in 1820 roughly 250 million people were earning $500 per year.

The blue line shows the income distribution in 1970. You can see that the world has gotten richer and more populous, but that the world is clearly divided into rich developed and poor developing countries. By 2000, however, the line has moved up and out -- showing a richer, more equal world.

中国的发展使得世界变成一个更平等的地方。

中国的发展在过去的几十年里已经使5亿人摆脱了贫困,这是也是联合国能完成所设置的如此多千禧年发展目标的主要原因。

下面的图表,来自马克斯拱形门世界的数据,表明中国的经济增长有着强大的影响力在左右世界各地的财富分配方式。

纵轴显示每百万人数,横轴显示每人每年收入。红色的线条代表的1820年全球收入分布。红线的峰值,表示在1820年大约有2.5亿人每年收入500美元。

蓝线显示的是1970年的收入分配。你可以看到世界上财富更多了,人口也更加稠密,但世界又明显地分为富裕发达国家和贫穷的发展中国家。然而,到2000年,这条线已经上升了,展示一个更富裕、更平等的世界。

Max Roser, Our World in Data

It has shifted the world's "economic center of gravity"

The map below, by the McKinsey Global Institute, shows something called the Earth's world's “economic center of gravity.” It's a little complicated, but the researchers basically weighted each country by an estimate of its GDP, and then used those weights to calculate the approximate economic center of mass of the world.

As the map shows, that center has moved over time. In 1,000 AD, China and India accounted for two-thirds of global economic activity, and the global economic center was firmly in the Middle East. It remained there for roughly 1,500 years before shifting to Europe with the advent of the Industrial Revolution, and then toward North America.

But East Asia’s stunning economic rise and urbanization in the last few decades, along with the growth of India and other emerging economies, has rapidly tugged the center back toward its origin. By 2025, the world’s economic center will be as far east as it was in 1,000 AD, though substantially farther north.

它已经改变了世界“经济重心”

下面的地图,来自麦肯锡全球研究院,表现了地球的世界“经济重心",有点复杂,但是研究者基本上是加权每个国家国内生产总值来进行估计,然后使用这些权重计算近似的世界经济重心。

中心的地图显示,已经随着时间的推移。公元1000年,中国和印度占全球经济活动的三分之二,并且全球经济中心稳定在中东地区,直到大约公元1500,由于工业革命,重心转向了欧洲,然后转向北美。

但是在过去的几十年里东亚惊人的经济增长和城市化 ,伴随着印度和其他新兴经济体的增长,迅速将此重心拽回到它的起源处。到2025年,世界经济中心将与公元1000年一样处于东边,尽管实质上会大幅往北偏移。

“No Ordinary Disruption: The Four Global Forces Breaking All the Trends." McKinsey & Company.

“非一般的重塑:四个全球力量打破先有的趋势"图片来自麦肯锡公司。

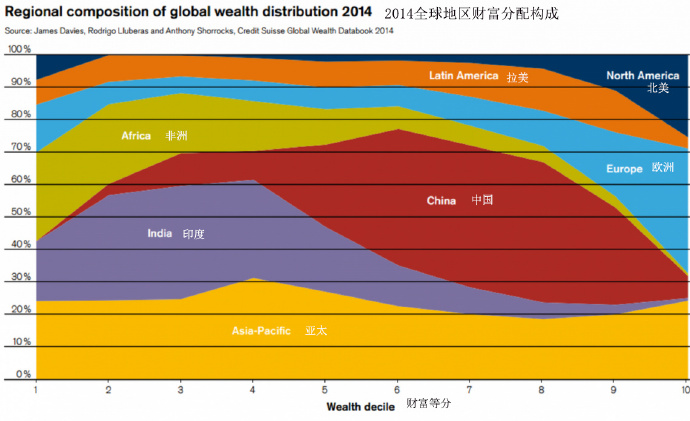

The Chinese are now basically the global middle class.

We don't usually think of the world having a middle class, but the Chinese are good candidates. The Chinese earn more than India, Africa and much of the Asia-Pacific but less than Europe and the U.S., as the graph below shows. The chart, from Credit Suisse's 2014 Global Wealth report, shows global wealth broken down by decile, or every 10 percent of the world wealth distribution.

现在中国人大体构成了全球中产阶级。

我们通常不认为世界上有中产阶级,但中国是一个很好的候选人。中国人赚的比印度、非洲和亚太等国家的人多但比欧洲和美国的少,如下图所示,此图表来自瑞士信贷(Credit Suisse)发布的2014年全球财富报告,显示十等份的全球财富分配分解图,或每10%的世界财富分配。

Credit Suisse 2014 Global Wealth report, https://publications.credit-suis ... 68-B041B58C5EA591A4

瑞士信贷2014全球财富报告, https://publications.credit-suis ... 68-B041B58C5EA591A4

China's economic rise is a return to a historical norm.

Americans tend to think of China’s rise as happening in the past few decades, but many Chinese have a longer memory. For most of the last 2,000 years, China was one of the world's biggest economies. China has one of the world’s oldest civilizations. To those with a long view of history, China's position as a relatively poor country in the early 20th century is the aberration, following thousands of years when the country was without question one of the world's great powers. The chart below shows just how dominant China's economy has been for the last 2,000 years:

中国的经济崛起是正在回归历史常态

美国人倾向于认为中国的崛起是发生在过去的几十年,但许多中国人有着更长的历史记忆。在过去2000年的大部分时间里,中国是世界上最大的经济体之一。中国是世界上最古老的文明之一,有着长远的历史。中国的立场是,在20世界的相对衰落只是其历史长河中的一次畸变,而在接下来的数千年中国将毫无疑问是世界上最强大的力量。下面的图表表明了持续了两千多年的占世界主导地位的中国经济。

Michael Cembalest, JP Morgan

(图片提供)摩根大通(JP Morgan)迈克尔 切巴莱斯特

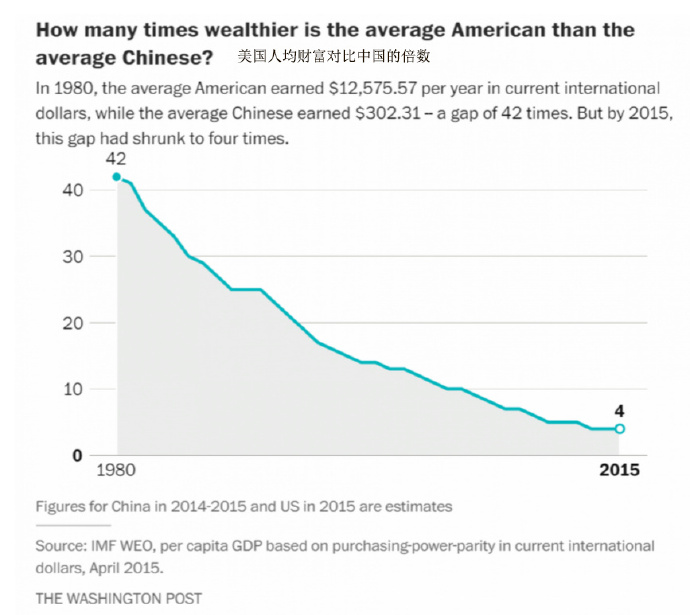

Chinese have gotten a lot richer -- but they're still not nearly as wealthy as Americans.

China's economy has developed a lot since 1980, as leaders loosened restrictions on private business and opened the country to the outside world. That has led to an incredible growth in Chinese incomes. Since 1980, the average Chinese person's income has increased more than 45-fold. Back in 2000, an average American was earning 13 times as much as the average Chinese; in 1980, the difference was 42 times.

That's incredible growth, but the Chinese are still far from catching up with Americans. As the chart below shows, the average American earned more than four times as much as the average Chinese person did in 2013, making $53,000 vs. $11,885. (This is on a purchasing power parity basis, which actually makes those in poorer countries seem relatively richer, since it accounts for the cheaper cost of many goods and services in poorer countries.)

中国已经富裕了很多,但他们仍然不如美国人富裕。

自1980年以来,中国的经济得到了快速的发展,其领导人解除私营企业的限制以及对外开放,造就了一个令人难以置信的收入增长。自1980年以来,中国人的平均收入增加了超过45倍。在2000年,美国人平均收入是中国人的13倍,而在1980年,这一差异为42倍。

这是令人难以置信的增长,但中国仍远未赶上美国人。下面的图表显示,2013年美国人均年收入超过中国的四倍的,分别是53000美元和11885美元。(这是基于购买力等价得出的结论,实际上这使得较贫穷的国家显得相对更加富裕了,因为这种算法使较贫穷国家算出的的许多商品和服务的成本降低了)。

Ana Swanson, Washington Post

China's wealth isn't spread around evenly.

China is now one of the world’s more unequal countries. Much of the wealth – and the country’s new crop of millionaires – is concentrated on the eastern coast, while in China’s interior hundreds of millions of people are still basically subsistence farmers.

The map below shows how that wealth is concentrated. The darker blue areas along the coast are the cities of Beijing and Tianjin in the north, and the city of Shanghai in the middle, where average incomes are more than three times as much as the interior.中国现在是世界上最不平等的国家之一。

大部分的财富——以及国家新晋的百万富翁都集中在东部沿海地区,而在中国内地仍有数亿人是贫困农民。

下面的地图显示,中国的财富十分集中。深蓝色显示的地区是沿海的北方城市北京和天津,还有在中间的上海。这些地区的人均收入是内地居民的三倍以上。

"GDP per capita of Chinese provinces" by cncs - 自制. Wikimedia Commons

China has nearly twice as many Internet users as the U.S. has people.

China is more connected than you might think. According to the China Internet Network Information Center, the country has nearly 618 million Internet users -- nearly twice as many people online in China as there are people in the United States. Five hundred million of those users in China are mobile Web users.

中国的互联网用户是美国的两倍

中国是比你想的更加信息化。根据中国互联网络信息中心的数据,中国全国有近6.18亿互联网用户在线——是美国的近两倍。其中有五亿是中国移动互联网用户。

China Internet Network Information Center

(图片提供)中国互联网络信息中心

Most foreign news sites are blocked in China.

China heavily censors its domestic Internet through the use of technology dubbed “The Great Firewall.” Yet the country’s censorship of certain individual sites can vary greatly with the news cycle. The graphic below, created by Sisi Wei for ProPublica, shows that censorship has become more extensive since pro-democracy protests began in Hong Kong last September.

Many of the tests were inconclusive (shown in yellow), meaning that some but not all of the servers tested showed signs of blocking. That could mean that some regions of China are blocking the site, or that Internet service providers are having technical difficulties.

However, many sites show signs of increased censorship. ProPublica found evidence of censorship on sites that were not often blocked before the protests, including Reuters and the BBC. The homepages of BBC’s Chinese service, Bloomberg, the New York Times, and the Wall Street Journal were completely blocked, as were Facebook and Twitter.

大多数外国新闻网站在中国被屏蔽。

中国使用被称为“TGF"的互联网技术大力审查其网络,而且中国审查制度可能对于某些网站和新闻周期有着很大的差异。下面的图形,由Sisi Wei for ProPublica,表明,自去年在香港开始皿主抗议活动以来,审查更宽泛了。

许多测试是不确定的(黄色所示),这意味着只有一些,而不是全部的服务器测试显示网站有屏蔽的迹象。这可能意味着,中国一些地区会封锁网站,或给互联网服务提供商在技术上设置障碍。

然而,许多网站审查显示出增长的迹象。ProPublica发现在抗议活动发生之前不常被审查的一些网站,如今也遭受审查,包括路透社和英国广播公司(BBC)。而BBC中国的主页,布隆伯格,《纽约时报》和《华尔街日报》则 像Facebook和Twitter 一样被完全封锁。

Sisi Wei, ProPublica

The Chinese government maintains among the world's tightest restrictions on religion.

As this graph by Pew Research Center shows, China has among the toughest restrictions on religion, defined as laws, policies and actions that restrict religious beliefs and practices. It is toward the extreme right-hand side of the graph, along with Indonesia, Iran and Egypt.

The chart also shows religious hostilities among private individuals on the vertical axis, a category that Pew says ranges from vandalism of religious property to violent assaults. Here, China doesn't rank so highly. Countries toward the top of the graph, like India, Nigeria, Bangladesh and Pakistan, have the most intense religious hostilities among private individuals

Roughly a quarter of the world’s countries face high levels of religious hostilities, while the same proportion has heavy religious restrictions, says Pew.

中国zf维持世界上最紧张的宗教的限制。

由皮尤研究中心这个图表显示,中国对宗教实行紧张的限制,表现为在法律、政策上对宗教信仰和宗教行为作出的限制。中国出现在图表的极右端,与印尼、伊朗和埃及靠在一块儿。

图表的纵轴还显示了各国人的宗教敌意状况,从暴力袭击的状况到对宗教财产的破坏进行排名分类。在这方面,中国排名不高。在图的顶部的国家,如印度、尼日利亚、孟加拉国和巴基斯坦,有最强烈的个人之间的宗教敌意。

尤皮称,世界上大约四分之一的国家面临紧张的宗教敌对状况,同样,世界上还有相同比例的国家实行沉重的宗教限制。

Some Americans are more worried about China than others.

Recent polls show Americans are very worried about Chinese cyberattacks, its growing military power, and the amount of American debt it holds — though actually, the Fed holds a lot more U.S. debt than China and Japan do. Concern about China varies a lot by political party, with Republicans far more concerned than Democrats are, as the poll below by Pew Global shows.

一些美国人比其他人更担心中国。

最近的民意测验显示,美国人非常担心中国的网络攻击,还有其日益增长的军事力量,以及持有美国国债的数量——尽管实际上,美联储拥有比中国和日本更多的美国国债。而不同政党忧心中国的程度也不尽相同,比如共和党就比民主党更关心来自中国的威胁,佩尤全球的调查显示如下。

Pew Global, http://www.pewglobal.org/2015/09 ... ttery-by-u-s-party/

皮尤全球,http://www.pewglobal.org/2015/09…ttery-by-u-s-party /

China's military is growing -- but the U.S. still spends way more.

The chart below, adapted from The Wall Street Journal, shows various national military budgets in 2013, when the Pentagon and other U.S. security agencies spent about $582 billion. Despite the forced reductions to our military’s budget, that was still an extraordinary amount of money compared to the smaller sums allocated by other countries around the world — more than China, Russia, the United Kingdom, Japan, France, India, Germany, Saudi Arabia, South Korea, and Brazil spent collectively. (That said, some of these countries are U.S. allies and would be forced to spend more without the protection of the U.S. military.)

中国的军事开支不断增长,但美国仍然比中国花费更多的钱在军事上。

下面的图表,改编自《华尔街日报》,展示了2013年不同国家军事预算,当时美国国防部和其他美国安全机构花了大约5820亿美元。尽管被迫削减军事预算,但相比于其他有着更少军费开支的国家仍是一笔不小的钱,超过中国,俄罗斯、英国、日本、法国、印度、德国、沙特阿拉伯、韩国、和巴西共的总和。(也就是说,有些国家是美国的盟国,如果没有美军的保护,他们就将要花费更多的钱用于军事开支)。

China has led to a loss in U.S. manufacturing jobs.

China's economic rise, and its entry into the World Trade Organization, has coincided with a loss in U.S. manufacturing jobs. The share of Americans working in manufacturing fell from more than 13 percent in the late 1980s to 8.4 percent in 2007, as trade with China increased and its imports into the U.S. soared, as this graph from researchers at MIT shows.

中国导致了美国制造业就业机会的损失。

中国经济正在崛起,并且加入了世界贸易组织,与此同时对美国制造业就业机会造成了冲击。从事制造业工作的美国人的比例从1980年代末的13%以上猛降至到2007年的8.4%,原因是美国与中国的贸易增加,来自中国的进口剧增,麻省理工学院的研究人员提供的此图表可以做出说明。

The China Syndrome, MIT

中国综合症,图片源于麻省理工学院

But China's cost advantage in manufacturing is disappearing fast.

As China's economy has developed, wages have risen, and so have the costs of land, energy and other raw materials. That means it is increasingly expensive to manufacture goods in China. Most of these jobs won't come back to the U.S. (though a few are) -- most will go to lower-cost countries like Vietnam, Bangladesh and Mexico.

The chart below, from Boston Consulting Group, shows how the competitiveness of manufacturing in China and Russia has changed over the past 10 years. Even when adjusted for productivity, Chinese manufacturing wages have risen by 187 percent over the decade. Industrial electricity costs have grown 66 percent, while natural gas costs are up 138 percent. In the same time frame, U.S. wages have risen only 27 percent, while natural gas costs have fallen 25 percent, according to Boston Consulting.

但中国的制造业成本优势正在快速消失。

随着中国经济的发展,工资上涨,所有土地、能源和其它原材料的成本上升。这意味着在中国制造产品将越来越昂贵。大多数这些工作不会回到美国(尽管有一些)——最终这些就业会流向制造成本更低的国家,如越南、孟加拉国和墨西哥。

从波士顿咨询集团提供的如下图表显示了中国和俄罗斯在制造业上的竞争是如何变化的。据波士顿咨询集团提供的信息,即使调整了生产力,中国制造业的工资也在过去的十年内上升了187%。工业用电成本增长了66%,天然气成本上涨了138%。与此同时,美国的工资只增长了27%,而天然气成本下降了25%。

Boston Consulting Group

波斯顿咨询集团供图

China is investing more in the U.S.

Between the 1980s and 2000s, the U.S. pumped a huge amount of foreign direct investment into China, but that investment moved largely in one direction. It wasn't until recent years that China began returning the favor, as its economy became more developed and its companies began going abroad in search of new products, markets and talented employees.

According to a report by Rhodium Group, an advisory firm, and the National Committee on U.S.-China Relations, a nonprofit, Chinese companies spent nearly $46 billion on acquisitions in the U.S. between 2000 and 2014, with most of that activity happening in the last five years. As the map below of Chinese commercial investment in the U.S. at the Congressional district level shows, investment between 2000 and 2014 varies a lot by location, likely due to the variety of local investment targets and the district's success at recruiting Chinese investors.

中国正在加大在美国的投资

在1980年代和2000年代之间,美国投入大量的直接外资投资进入中国,但投资很大程度上只向中国一个方向移动。直到最近几年,中国才开始反哺,随着中国经济越来越发达,中国公司开始出国寻找新产品,新市场和有才华的员工。

根据一个非盈利性的,研究中美关系的全国委员会咨询公司Rhodium Group的报告,中国企业从2000年至2014年花了近460亿美元在美国从事并购活动,大部分并购发生在过去的五年里。根据这份中国在美国国会选区的商业投资水平地图显示,在2000年和2014年之间商业投资因地理位置的不同而差异明显,这是地方上设置的投资目标和部分地区对中国投资者的成功吸引所造成的差异。

Rhodium Group

荣鼎集团

China is gobbling up global resources at an incredible pace.

China is reshaping the world is through its voracious appetite for resources, to feed its factories and build new roads and cities. China accounts for about half of the aluminum, copper, nickel, steel and concrete used worldwide each year, making it a major customer for resource-rich countries like Australia and Brazil.

中国以不可思议的速度吞噬全球的资源。

中国正在通过对资源的巨大需求来重塑整个世界!为了满足工厂的生产以及建设新的道路和城市。中国有着约一半的全球铝、铜、镍、钢铁和混凝土消耗量,这使它成为诸如澳大利亚和巴西这样资源丰富国家的主要客户。

Visual Capitalist, http://www.visualcapitalist.com/ ... aw-materials-chart/

China is grabbing up land around the world -- but so is the U.S.

Researchers at Lund University in Sweden found that most of the world’s countries had bought or sold land internationally as of 2012 – 126 of the 195 countries recognized by the UN, according to their report. But the trade is dominated by just a few players, namely China, the U.K. and the U.S.

The map below shows where governments and agribusinesses are buying and leasing land in foreign countries. Countries that are more engaged in buying land internationally are shown in grey or shades of yellow, while countries that sell more land are shown in red. The bigger the circle, the more trading partners a country has.

China ranks as the most active country in the world in land trade, purchasing land from 33 countries and but selling it to only three. The U.S. is a close second, buying land from 28 countries and selling to three, following by the U.K., which bought land from 30 countries.

中国正在收集世界各地的土地——美国也是如此

瑞典隆德大学的研究人员发现,截止至2012年,世界上大多数国家有着国际土地买卖的记录,根据他们的报告,联合国的195个国家中的126个有国际土地买卖行为。但这种贸易只有几个主要玩家,即中国、英国和美国。

下面的地图显示了地方政府和农业企业在国外购买和租赁土地的状况。国家参与国际购买土地的状况用灰色或黄色的阴影所示,国家出售较多土地则被显示为红色。圆越大,表示其有着越多土地交易伙伴国家。

中国是世界上最活跃的国际土地交易者,从33个国家购买土地,但卖出的只有3个。美国紧随其后,从28个国家购买土地和销售土地给3个别的国家,英国第三,买了来自30个国家的土地。

Architecture of the global land acquisition system, http://iopscience.iop.org/articl ... B0EC973F6FBBAEA2.c1

But China's economy appears to have a problem -- it relies too much on investment.

Economists look at growth in terms of three main drivers: A country's exports, its consumption (all the goods and services that normal people and the government buy), and investment, which includes money spent on factories and houses. When you compare what these three drivers look like in China versus other countries in the world, China's economy starts to look very unusual.

More of China's GDP comes from investment than in any other country in modern history -- even countries that rapidly industrialized as China is doing, like Japan and Korea, as the chart below from Credit Suisse shows. And as a result, a much lower proportion of growth comes from consumption in China than it does in other countries, as the next chart shows.

Some economists argue that this is okay, but many others see it is a worrying sign. They believe that China is pumping too much money into investment, and that that practice is creating a property bubble and excess capacity in factories.

This is why many are urging China to "rebalance" -- to shift its economic model to rely more on consumption and less on investment. China has a slew of policies that incentivize investment, including cheap financing and resource prices, and these would have to be unwound in order to rebalance.

但中国经济似乎有一个问题——它过度依赖于投资。

经济学家从三个主要因素看待经济增长:一个国家的出口,其消费(普通人和政府购买的所有商品和服务),以及投资(包括钱花在工厂和房子的投资)。当你比较中国和世界上其他国家的这三个因素,你就会发现中国的经济开始变得很不同寻常。

中国的GDP更多地来自于投资,比现代任何一个国家的都要多,甚至包括那些和中国一样迅速工业化的国家,例如日本和韩国。瑞士信贷(Credit Suisse)展示了下面的图表。可以看到,与其他国家相比,中国来自于消费的增长的更低。

一些经济学家认为,这是好的,但更多人觉得这是一个令人担忧的迹象。他们认为中国注入了太多的钱做投资,这种做法只会制造房地产泡沫和在工厂产生过剩的产能。

这就是为什么许多人敦促中国要“再平衡”——经济模式转向更多地依赖于消费而不是投资。中国必须解除一系列诸如鼓励投资,提供廉价的融资和资源价格的政策,以实现再平衡。

Reserve Bank of Australia

That is leading to a worrying amount of debt.

China's huge investments in recent years have caused the debt owned by the government, banks, corporations and households to balloon to 282 percent the size of the economy. That's a far higher debt burden than most developing countries, as well as Australia, the U.S., Germany or Canada, as the graph below from McKinsey & Company shows. Some of these loans will probably never be paid back.

这导致了令人担忧的债务规模

近年来中国的巨额投资造成归政府,银行、企业和家庭所有的债务的规模膨胀到282%。这些债务负担远远高于大多数发展中国家,还有澳大利亚、美国,德国或者加拿大。来自麦肯锡公司的图表显示。其中的一些借贷可能永远无法被偿还了。

McKinsey and Company, http://www.mckinsey.com/insights ... t_much_deleveraging

Nearly half of that debt is tied up in the property market.

Property development has been a huge generator of wealth for the country in recent years, and it is now also a massive repository for its debt. Repeated wins in the property market encouraged some developers and financiers to take on risky and unnecessary projects, including miniature versions of Paris and Manhattan.

McKinsey estimates that, excluding the financial sector, almost half of China’s debt is directly or indirectly related to real estate, about $9 trillion. The property market is very diffuse, with more than 89,000 mostly small property developers contributing about 15 percent of the country's GDP growth and accounting for 28 percent of fixed-asset investment.

近一半的债务绑定在房地产市场上。

房地产开发是近年来为国家创造了巨大的财富,但现在也造成了巨大的债务规模。然而房地产产业再三地创造财富奇迹,刺激了一些开发商和金融家承担风险去开发不必要的项目,包括一些所谓的缩小版巴黎和微版曼哈顿。

麦肯锡估计,不包括金融部门,几乎一半的中国的债务是直接或间接地与房地产相关,约9万亿美元。中国的房地产市场非常分散,有超过89000小房地产开发商贡献了约15%的国内生产总值增长,占固定资产投资的28%。

McKinsey & Co

Much of the rest is in the hands of local governments.

China's provinces, cities and counties are actually responsible for racking up a lot of the debt, rather than the federal government. Since 2007, local governments have propped up their growth rates with huge investments. To finance these investments, they turn to something called "local government financing vehicles," or LGFVs. Local governments are technically prohibited from borrowing in China, so they circumvent this restriction by having LGFVs borrow on their behalf.

剩下的大部分债务都是在地方政府的手中。

中国的省、市、县实际上很多都是债台高筑,而不像联邦政府那样。自2007年以来,地方政府用巨额投资支撑起了其增长率。为了融资,他们推出了所谓的“地方政府融资平台”,或称为LGFVs。中国地方政府在严格的法律意义上是禁止借贷的,所以他们绕过这个限制,通过地方政府融资平台贷款。

McKinsey & Company

China is the world's most active source of illicit financial flows.

China tops the list as the biggest source of illegal money in the world, followed by India, Mexico and Russia, as the map below by Global Financial Integrity shows. China exported just under $250 billion in illicit financial flows in 2012, which includes laundered funds, drugs, under-the-table payments, and untaxed income.

中国是世界上最活跃的非法资金流动的来源。

全球金融诚信地图显示,中国位列榜首成为世界上最大的非法资金来源,其次是印度、墨西哥和俄罗斯。中国在2012年流出了2500亿美元的非法资金,这其中包括洗钱资金,毒品,黑幕交易,和逃税收入。

Global Financial Integrity

Is the U.S. or China more responsible for global warming? It depends on how you look at it.

These graphs from the Global Carbon Project show different ways of visualizing who is responsible for producing and curbing carbon dioxide emissions.

The first graph, which breaks down total emissions since 1870 by country and continent, highlights the huge historical role of the US and Europe in producing carbon; China is just a tiny blip at the right. The second graph of annual carbon dioxide emissions shows that China surpassed the US as the world’s largest carbon emitter in 2007, and that its emissions are still growing quickly. The last graph offers yet another view: That even though China is now the world’s largest carbon emitter, its per capita emissions are still less than half those of the US.

是美国还是中国对全球变暖负有更大的责任?这就要见仁见智了。

全球碳计划的这些图表通过不同的方式,可视化了谁应对生产和遏制二氧化碳排放负责。

第一个图,它分解了自1870年以来各个国家和大陆的二氧化碳的总排放量,突显显示了美国和欧洲对碳排放的巨大历史作用,当时中国的碳排放量只是一个小数量。第二个图表表示了年度二氧化碳排放量,从这个表中可以看出,中国于2007年超过美国,成为全球最大的碳排放国,其排放量仍在快速增长。最后一个图提供了另一个观点:尽管中国现在是世界上最大的碳排放国,但其人均排放量仍不到美国的一半。

Global Carbon Project

China uses almost as much coal as the rest of the world combined.

If you're wondering why China is such a big producer of carbon, here's one clue. Because the country is relatively rich in coal and poor in other kinds of energy, much of China's economic growth has been fueled by coal. China accounted for about 82 percent of the 2.9 billion tons of global coal demand growth since 2000, according to the U.S. Energy Information Administration, which created the chart below. China now accounts for 47% of global coal consumption—almost as much as the entire rest of the world combined.

中国的煤消耗量差不多是世界其他国家的总和。

如果你想知道为什么中国排放如此多的温室气体,这是一条线索。因为中国有着相对丰富的煤炭资源而缺乏其他能源,煤炭作为主要能源推动了中国的经济增长。自2000年以来,中国占据了全球29亿吨煤炭需求增长中的82%,美国能源信息管理局提供了下面的图表。图表显示中国现在的煤炭消耗占全球煤炭消耗量的47% ,需求几乎高达整个世界其他国家的总和。

wintersoldier

12:25 AM GMT+0800 [Edited]

Jus finished. Those charts are more education about China than I've had the entire rest of my life. Shows what can be accomplished in a single article. Kudos!

LikeReplyShare4

全部看完了。这些图表带给我对中国的认知比我一生中所知道的都多。在单独的一篇文章中就能实现如此丰富的内容,赞一个!

wintersoldier

9/25/2015 11:57 PM GMT+0800

"LGFVs" ... like when Obama gave Christie 1 billion dollars to help SAndy victims and he proceeded to launder it to his political supporters real estate investments. How's that account doing, since I still think of it as taxpayers' money. Silly, right?

LikeReplyShare1

“地方政府融资平台”…就像当奥巴马给克里斯蒂10亿美元帮助台风桑迪受害者时,他继续为他的政治支持者的实际的房地产投资洗钱一样。但我仍然认为这是纳税人的钱,这笔账该怎么算?这很愚蠢,对吧?

Cncrictic

9/25/2015 11:19 AM GMT+0800

Finally, somebody have a fairer view about China. Well, At least I only care about food. LOL.

Economic situation is going down in China anyway.

LikeReplyShare

终于有人客观地评价中国了。好吧,至少我只关心我的食物。LOL

不管怎样,中国的经济形势将走下坡路。

Nera Everlasting

9/25/2015 3:30 PM GMT+0800

China's economy down only in west medias! They always said it since 10 years agp! LikeReply

中国经济只会在西方媒体中下滑!西方媒体十年前就是这些个论调!

johnw3318

9/25/2015 4:03 PM GMT+0800

lol. Yeah, I forgot, a plunging stock market is considered growth in the Chinese media isn't it?

China's government has no respect for human rights and you have no respect for facts. China is not everlasting, its human.

LikeShare2

哈哈,是啊,我忘了,股市暴跌在中国媒体上是一种增长,不是吗?中国zf没有尊重人权,而你没有尊重事实。中国不会长久的。

jjlovet

9/25/2015 4:23 PM GMT+0800

@johnw3318

transition from export-based to consumer-based economy

of course will cause a lot of stumbling

the question is will china gov manage the transition well

LikeReply1

实现从出口导向型到消费导向性经济的转变,肯定会遇到许多障碍。关键就看中国ZF能否成功引领转型了。

Yi He

12:59 AM GMT+0800

Economic situation is going down in China anyway

This statement is getting old, I've heard things like that constantly for decades, every time experts present "solid evidence" to back their theory. Truth is, China is still growing

LikeReply1

中国的经济形势将走下坡路。

这种说法已经相当过时了,我持续十几年不断地停到类似的论调,而且每次都有专家给出了“确凿的证据”来证明他们的观点。但事实是,中国经济仍在增长。

loyalbuilt

9/25/2015 12:48 PM GMT+0800

Must say this is one of the rare articles that describe China relatively objectively. Don't be brainwashed by anybody, be it communist propaganda or western bias.

LikeReplyShare2

不得不说这是一篇少有的客观描述中国的文章,不要被任何人洗脑了,无论是共产主义还是西方偏见。

bpai_99

9/25/2015 2:48 PM GMT+0800

Fascinating article and great charts. It will be interesting to see if China can avoid imploding over the next several decades. The political, economic, social (esp. demographic) stresses will be getting worse for the foreseeable future and it's difficult to imagine the Party will be able to keep a lid on it forever.

LikeReplyShare2

真是有趣的文章,还有上等的图表。看看中国未来几十年是否可以避免崩溃真是件有趣的事情。中国政治、经济、社会(特别是人口)的压力在可预见的未来将会变得更糟,很难想象党能够控制它,直到永远。

Unisol Formosan

8:10 PM GMT+0800

Basically, this article is nothing more than propaganda for China. Yes, the country is supposed to be multi-national. But Chinese intentionally created a concept as ``Zhong Hua Min Zu``( It`s hard to translate. Han ethnic group centered concept. It intentionally including Tibetan, Manchurian,Mongolian,etc as Chinese). Everything such as history is fabricated and twisted in China. Everything is lie. Good example is the map( probably using source from China) which including Taiwan........Really really stupid.

LikeReplyShare

基本上,这篇文章只不过是对中国的宣传。是的,中国的确实一个多民族的国家。但中国刻意创建了一个“中华民族”的概念(这很难翻译。这是以汉族为中心的概念。它试图把西藏人、满族人、蒙古人等都囊括为中国人)。一切中国的历史都是捏造和扭曲的,一切都是谎言。很好的例子就是上面这些地图(可能都是源于中国在使用的那种),这些地图把台湾包括了进去........这真的很愚蠢。

版权声明

我们致力于传递世界各地老百姓最真实、最直接、最详尽的对中国的看法

【版权与免责声明】如发现内容存在版权问题,烦请提供相关信息发邮件,

我们将及时沟通与处理。本站内容除非来源注明五毛网,否则均为网友转载,涉及言论、版权与本站无关。

本文仅代表作者观点,不代表本站立场。

本文来自网络,如有侵权及时联系本网站。

图文文章RECOMMEND

热门文章HOT NEWS

-

1

Why do most people who have a positive view of China have been to ...

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

推荐文章HOT NEWS

-

1

Why do most people who have a positive view of China have been to ...

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10